TL;DR – Tia gong Minister Tan See Leng excited about the support for workers and employers until heart rate increase sia!

In case you never catch the long, long Budget 2022 speech delivered by our new yandao Finance Minister Lawrence Wong today, here are 10 key things that YOU need to know! I give summary until so chee cham, don’t just scroll to the GST and ang pow parts hor!

-

Budget 2022: Gahmen will help vulnerable workers

To support lower-income workers, the qualifying income cap for Workfare will be raised from $2,300 to $2,500 per month, from Jan 1, 2023. Over the next two years, the Gahmen will also push out several changes to support them!

You know the PWM that NTUC first introduced in 2012? It will be extended to the retail, food services and waste management sectors, as well as to cleaners, security officers, landscape workers, administrators and drivers across all sectors… But then hor companies will kena higher labour costs right? To save them, the Gahmen also wants to introduce a Progressive Wage Credit Scheme (PWCS) to co-fund the wage increases of lower-wage workers from this year till 2026!

-

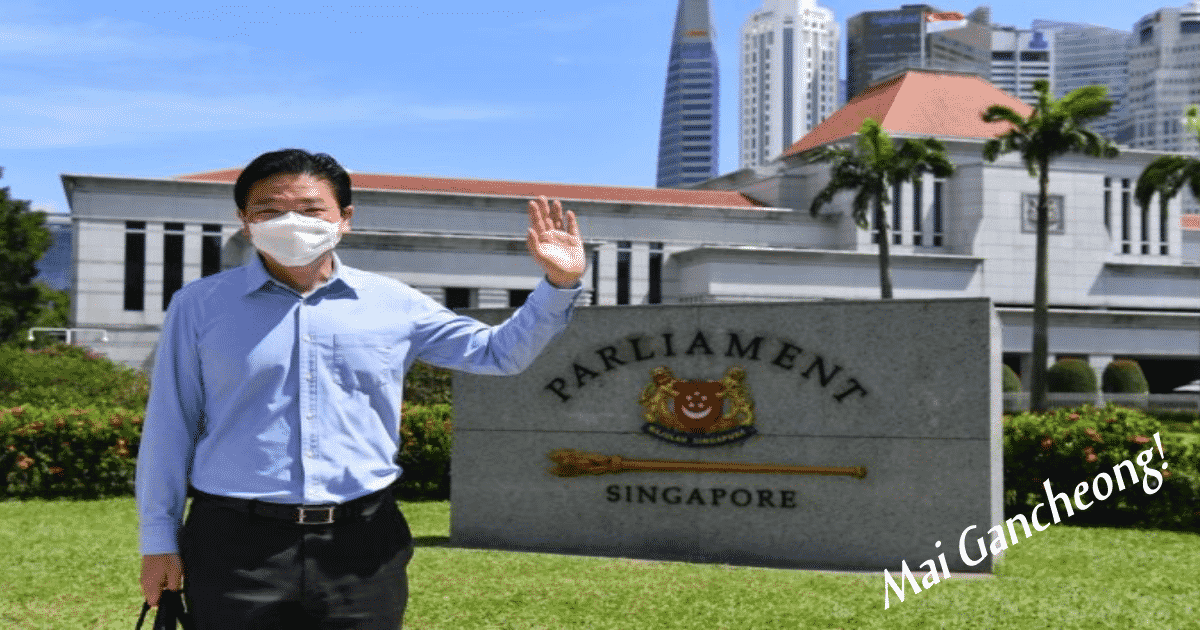

GST will go up… But not NOW, don’t gancheong!

Gahmen knows the aunties, uncles really cannot tahan the rising costs now already, so… they will delay GST increase AGAIN. GST will first increase from 7 per cent to 8 per cent on Jan 1, 2023 and then increase from 8 per cent to 9 per cent in 2024. Not bad lah hor. Can have some 心理准备 (be mentally prepared)…

-

Minimum qualifying salary for Employment Pass applicants raised…

From September 2022, the minimum qualifying salary for new EP applicants will be raised from the current $4,500 to $5,000. For the financial services sector, this will be raised from the current $5,000 to $5,500. Besides the salary, the Government will also improve how EP applications are assessed – this one can help improve the diversity of the foreign workforce!

-

Special attention will be paid to mature workers

A new SkillsFuture Career Transition Programme will help to enhance the provision of high-quality, industry-oriented training courses. The courses will be highly subsidised, and after the training, they will also help maximise jobseeker’s prospects.

-

SMEs got help too!

Workers and businesses in sectors that are still struggling will receive $500 million through a Jobs and Business Support Package! Eligible SMEs will get a payout of $1,000 per local employee, capped at $10,000 per firm. To support companies with their cash-flow needs if they really 钱不够用(money no enough), the Temporary Bridging Loan Programme and the enhanced Trade Loan Scheme will be extended for another six months.

-

More help… for Singaporean workers (which is most of us right?)

Gahman will give $100 million to help NTUC scale up Company Training Committees. $$$ put to good use to help workers!! You know ah – since the initiative started in 2019, NTUC has already formed more than 800 CTCs with companies and helped many, many workers!

Also, workers who continue to face income loss due to the pandemic can apply for the Covid-19 Recovery Grant – extended till the end of this year liao!

-

Erm, tax system to be enhanced to raise additional revenue

Singaporeans wants world-class education, good healthcare, cheap and good housing, better jobs… But money drop from sky ah? (You pay, he pay, they pay lah?) But it’s only fair that we all must pay a bit, no meh… So jeng jeng, the tax system will be enhanced to raise additional revenue. Ah gong how rich also must keep reserves for use in major crises and emergencies tio bo? Cannot just take and take lah…

-

Ang pows for your family – vouchers and rebates to cope with higher prices

Don’t say pay-and-pay hor. A new Household Support Package can help with your utility bills, children’s education and daily essentials. Rising costs of living… If you want to every day Hai Di Lao and sashimi then sorry lor… But lower-income families will find this support very helpful!

Got doubled GST Voucher! U-Save rebates for the rest of the year… Additional $200 top-up per child through the Child Development Account, Edusave Account or Post-Secondary Education Account, $100 worth of CDC vouchers… Altogether, the Household Support Package will cost about $560 million!

-

More electric vehicle charging points near our homes!

Singapore plans to phase out internal combustion engine vehicles by 2040. In the meantime, significant incentives have been provided for EV adoption. Don’t worry, more charging points will be built closer to where people live, to further accelerate EV adoption. Greener city!!!

-

Budget 2022: Last but not least hor, “Never say die”

“Adversity has not weakened us. Instead, it has strengthened our steel, deepened our bonds, and brought us closer together as one united people.” – Lawrence say one.

Like Mr LKY said before, Singaporeans are just champion grumblers la. But when crisis comes, we stand together and do our best. So ah, don’t worry, must steady ok? Budget 2022: Lawrence Wong promise Gahmen will help already!

P.S. Most importantly, heng ah, siam GST another year…

P.P.S. Tia gong Minister Tan See Leng excited about the support for workers and employers until heart rate increase! (See comments in SGAG’s post!)

https://www.facebook.com/sgag.sg/posts/5614759441872331

If you’d like to contribute your story to us, drop us an email at editors@sureboh.sg and we’ll review it. We read each submission that comes to us within two weeks of receiving it.