CAI SHEN DAO! DENG DENG DENG DENG DENG! CAI SHEN DAO! DENG DENG DENG DENG DENG!

In case you missed the two-hour Budget 2021 speech delivered by Minister Heng Swee Keat in Parliament today, here are 5 key takeaways that you need to know.

1. Lots of help for businesses and industries, especially those hit hardest by COVID-19 pandemic

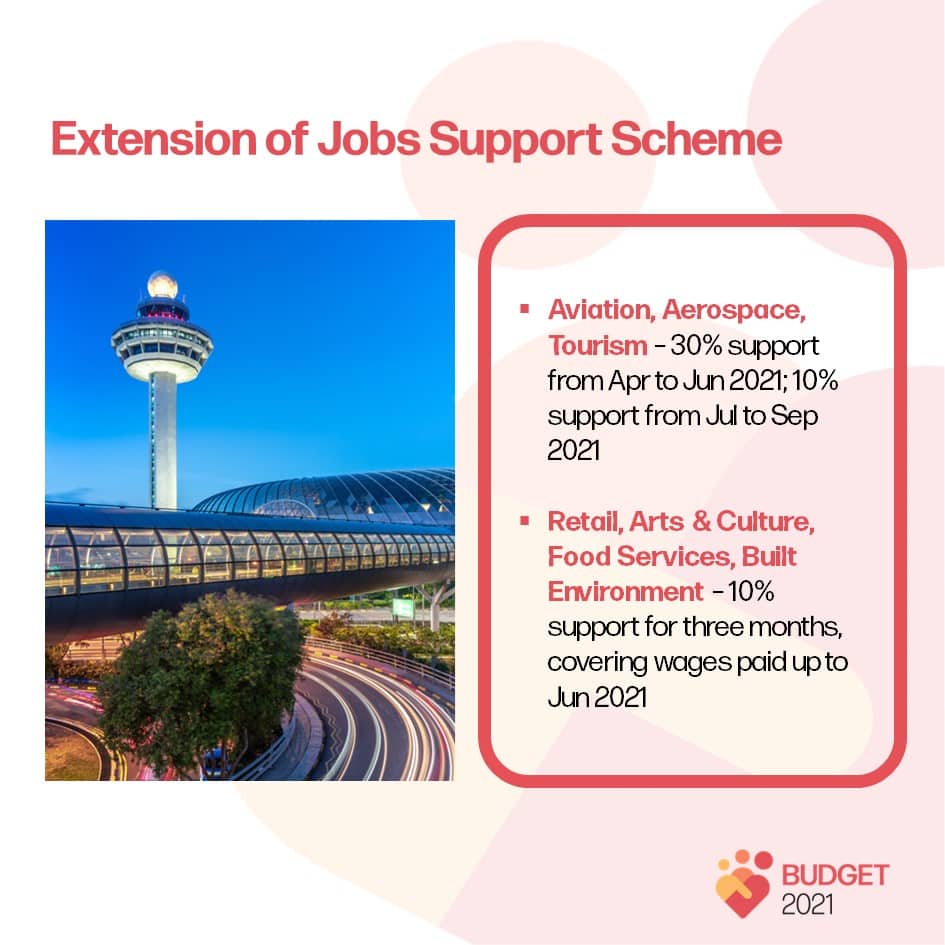

Jobs Support Scheme (JSS) will be extended for sectors that are hit hard by the COVID-19 pandemic, to help to be able to continue to keep their workers by covering a portion of their wages.

Eh say is help businesses lah, but actually if you think about it hor, in a way is also to help the workers keep their rice bowl lah.

Ah Keat say this JSS extension will cost the Gahmen $700 million.

By the way, more targeted support will also be given to the more qi-cham industries such as the aviation companies, taxi and private hire car drivers, arts & culture, and the sports sector.

The Gahmen also will allocate $24 billion to help businesses to transform for the future.

For local enterprises, Gahmen will throw in $1 billion (co-funded with Temasek) to help these companies redesign jobs to keep up with the emerging trends.

2. More help for Singaporean workers and jobseekers

Gahmen will also be setting aside $1.5 billion for the SGUnited Jobs and Skills Package, with mature workers, people with disabilities, and ex-offenders receiving additional support.

The COVID-19 Recovery Grant will also be available to support workers who lost their jobs or most of their income, and who are committed to job search and training.

There will also be a second tranche of the Jobs and Skills Package, on top of the $3 billion allocated in 2020 to support the hiring of 200,000 locals this year, and to provide up to 35,000 traineeship and training opportunities.

Plans to expand the Progressive Work Model to more sectors are also in the works to uplift more low-wage workers.

Budget for the Senior Worker Early Adopter Grant and the Part-Time Re-employment Grant will be increased by over $200 million to encourage more companies to NOT 嫌弃 (look down on) older workers and raise their retirement and re-employment ages, let them continue to work if they wish to.

3. Nurses and healthcare workers to get pay raise

Song bo! If you are missy or you work in the healthcare industry, good news for you!

Now you don’t just get some bo liao clappings from the window liao. Gahmen is going to give nurses and healthcare workers a pay raise to show their appreciation!

Is it time to consider joining the healthcare sector? Tia gong they need more people to join wor.

4. Ang bao for your family!

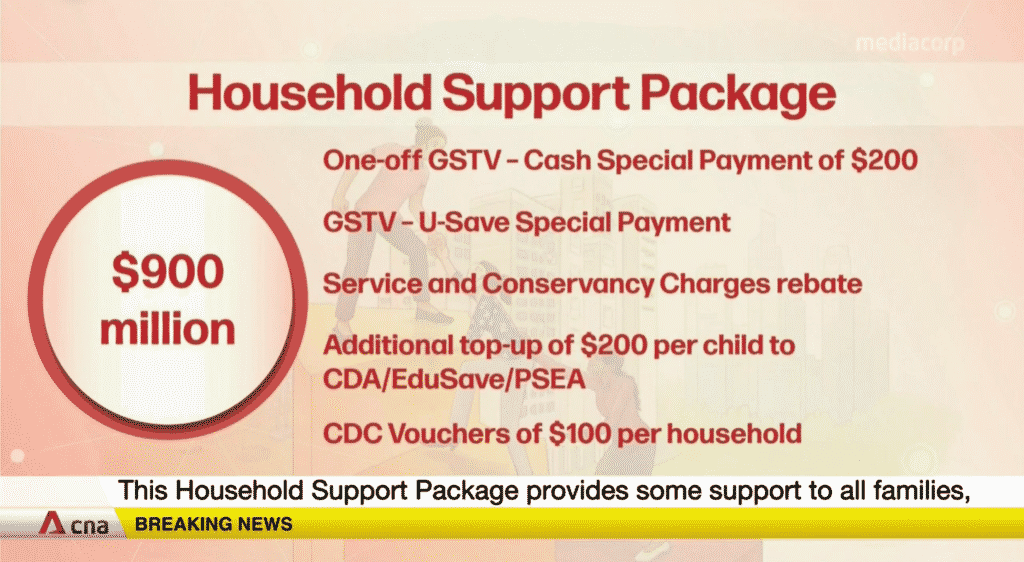

Eligible Singaporeans will receive a one-off GST Voucher – Cash Special Payment of $200, on top of the regular GSTV – Cash payment.

The Service and Conservancy Charge (S&CC) Rebate of 1.5 to 3.5 months will be extended for all eligible households for another year.

GST Voucher – U-Save Special Payment will also be provided to eligible HDB households, amounting to an additional 50% U-Save rebate over one year. Each household will receive additional utilities rebates of between $120 and $200 this year.

A top-up of $200 per child will be given to households with Singaporean children below the age of 21, through the Child Development Account, Edusave Account, or Post-Secondary Education Account, to further support parents as they invest in their children’s future.

All Singaporean households will receive $100 worth of CDC vouchers which can be used at participating heartland shops and hawker centres.

5. Petrol Duty rates will be raised with immediate effect

It will be raised by 15 cents per litre for premium petrol and 10 cents per litre for intermediate petrol.

By now you should have realised our Gahmen got take, but they also got give one. So, to ease the transition, they will be giving 1 year road tax rebates for the different vehicle types. Because hor the raise so sudden right, confirm a lot of people, especially motorcycle owners.

Active Private Hire Drivers and Taxi Drivers will also be given petrol rate rebates to offset the changes.

Others

On top of these goodies, Ah Keat also assured that all Singaporeans will get free COVID-19 vaccinations – if you willing to take it lah, of course. Nobody will take a knife against your neck and force you, or roll out red carpet to beg you to take de hor.

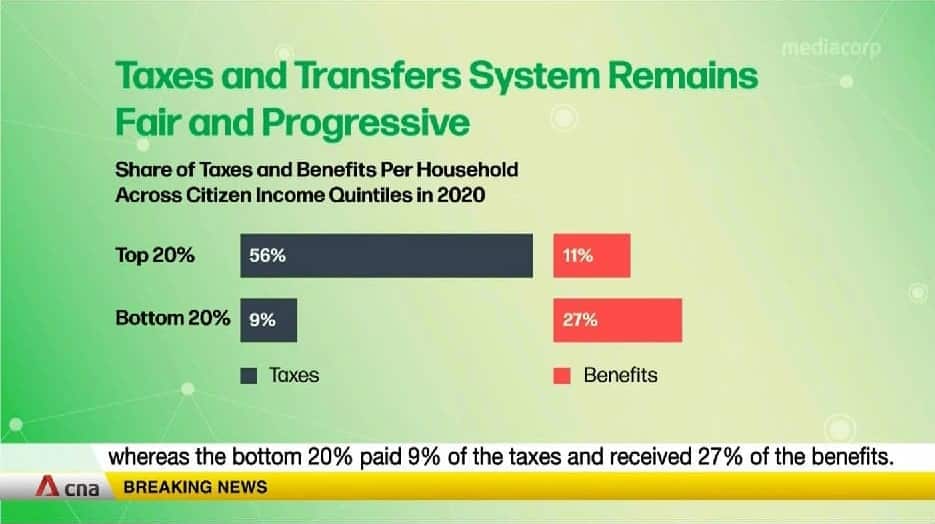

Ah Keat also assured that the GST will NOT increase in 2021. But don’t be too happy yet because cannot postpone the increase for too long one. It will have to be implemented between 2022 and 2025 because we still need to support the recurrent spending needs.

Even so, you can don’t need to worry about the GST increase lah, because Gahmen got set aside money to help those who need help and ease the transition.

And hor and hor, you might have realised that Ah Keat also reported 2 consecutive years of deficits during his budget delivery.

Chill and calm your tits first please. Don’t need to kan jiong yet ok. Because this one is normal. In other words, nothing wrong with having deficits, especially with the current economic situation and the ongoing pandemic. And also, don’t forget, the Gahmen is also using the money they saved in the past to help Singaporeans to get through the COVID-19 pandemic.

So hor, relac ok? Mai stress, mai kan jiong.

Everybody huat ok?

If you’d like to contribute your story to us, drop us an email at editors@sureboh.sg and we’ll review it. We read each submission that comes to us within two weeks of receiving it.