We published an article a few days ago on what some experts, non-governmental groups and MPs suggested to help Singapore chart a different future.

This included Economist Walter Theseira’s idea on ending the use of CPF for housing.

While his idea sounds completely out of whack (where got enough money to pay as cash down-payment for resale flats?!), there’re actually good reasons to analyse his suggestion.

Walter told Sure Boh Singapore that he had an interview with The Straits Times and his views were not fully published (therefore taken out of context). The media outlet has since clarified his original view.

In summary, here’s what he really wanted to say about not using CPF to pay for housing:

- Cut CPF contribution rates, focus on retirement and health

- That means more take-home pay for housing

- “Unlocking CPF funds” mindset might lead to over-investment in housing

- Retirement adequacy would then be affected

- Maybe still important to use CPF to help people save for first home

For those interested, here’s what he really said and meant (in his own words):

On redesigning the CPF system:

“What I argued is that the CPF system could be redesigned so that people no longer need to pay for housing out of CPF, by cutting contribution rates to focus on retirement and health.”

On how the CPF system tries to over-achieve:

“My view is that the CPF system tries to do a little too much, and we should consider focusing CPF on retirement and health.”

On over-investing in housing:

“I do believe there is some over-investment in housing, which creates retirement risks if housing values do not grow, and this over-investment is because Singaporeans see housing as a way of unlocking their CPF funds.”

On reducing CPF contribution rates:

“A CPF system focused on retirement and health would require lower contribution rates, and allow people more choices in using their higher take-home income on housing, investments, business, and family.”

On not having a fixed formula:

“What the right contribution rate should be, I cannot say. Perhaps some housing component remains important to help people save for their first home. Nor would I argue to remove CPF, because mandating retirement savings remains important, even for (especially for?) people who believe they can do a better job on their own. But this is a topic for another day.”

His Facebook post here:

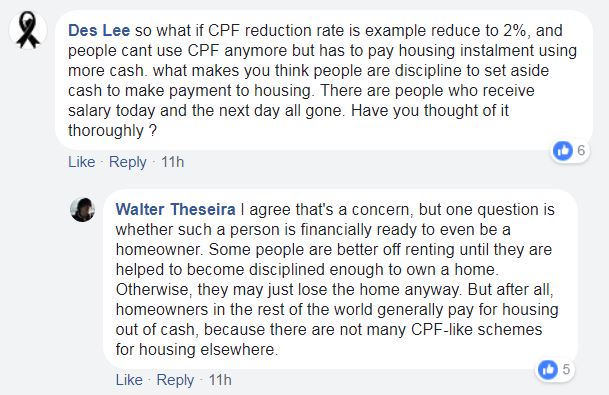

And if you’re concerned that people may not have the discipline to save for housing if CPF contribution rates are reduced, here’s what Walter has to say:

If you’d like to contribute your story to us, drop us an email at editors@sureboh.sg and we’ll review it. We read each submission that comes to us within two weeks of receiving it.