A reader wrote to us about how his mother lost almost $20,000 to scammer and want us to publish the story to warn others.

But because the story is rather lengthy, we’ve summed up what happened in a summary below:

- Reader’s mother received a phone call from an anonymous man (let’s call him Scam Man) offering her a loan.

- Mother decided to find out more about how the loan works because she was keen in getting a loan of $60,000.

- Scam Man told mother that her loan request amount is too high, and he would need to check her CPF account to see if she is qualified for the loan.

- Scam Man also said that he would only sent mother the details of his company after verifying her CPF contribution statement.

- Scam Man told mother that she’s unable to get a loan of $60,000 but he is willing to “close one eye” and offered her $20,000 instead and provided her with an invoice for the agreed loan amount.

- Mother, who’s not good in English, was convinced that the invoice sent to her was legit.

- Scam Man then requested for mother to pay an “admin fee” before transferring her the $20,000.

- Mother went around borrowing from friends and relatives to pay off the “admin fee” for the $20,000 loan.

- After paying the “admin fee”, Scam Man told mother that the $20,000 has been transferred to her. However, mother did not receive the money in her bank account.

- Scam Man then informed mother of an additional “processing fee” required by the bank for mother to receive the $20,000 and that the bank would later get in touch with her.

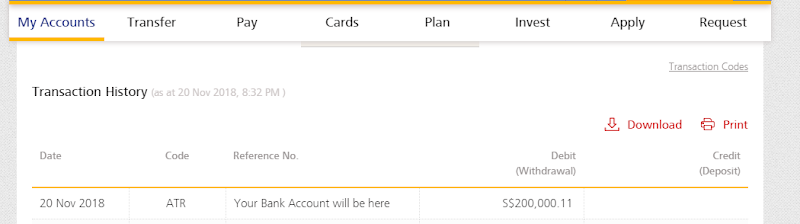

- Scam Man assured that the money had been transferred to mother by providing her with a screen shot of the (presumably photoshopped) transaction as prove.

- Mother later received a call from a private number, from someone claiming to be a Bank Manager.

- Bank Manager told mother that she’d need to transfer a “processing fee” to a bank account for the bank to clear the transfer so that she can receive the money.

- Again, mother went around borrowing money from friends and relatives to pay off the “processing fee” to the bank.

- Mother did not receive the money in her bank account despite paying for the “processing fee” and decided to call Scam Man to clarify.

- Scam Man then told mother that he will get his Manager to check.

- Manager later apologized to mother and said that they have “accidentally” entered an amount of $40,000 into their system and therefore mother would have to send them another amount of “admin fee” for the $40,000.

- At this point, mother became “shocked and confused” and therefore, she “wasn’t thinking” and was simply “doing whatever they asked”.

- In merely 2 days, mother had sent almost $20,000 to the alleged scammer.

Reader asked bank to freeze alleged scammer’s bank account

The reader who wrote in claimed that he’d eventually found out about the alleged scam through his cousin.

He then went on to contact the bank after finding out the bank account number which his mother has been transferring her money to. He was also informed by the bank that they do not have policy such as transferring “admin fee” to the bank to receive a sum of money.

Reader requested for the personal details of the account holder from the bank, but was rejected – According to the Banking Act, regardless of whether the account holder is dead or alive, the bank cannot anyhowly disclose anything without the account holder’s consent or in the absence of an Order of Court for probate or Letter of Administration.

Next, the reader asked if the bank could freeze the alleged scammer’s bank account and transfer the money back to his mother. Unsurprisingly, his request was turned down too – Because a bank can only freeze a bank account upon a court order and also, account holder’s authorization is necessary for the bank to proceed with a reversal.

Fortunately, the reader and his brother managed to stop their mother from making another mistake in the nick of time – they found her at an ATM, ready to transfer another sum of money to the alleged scammer – Heng ah.

The brothers then contacted the alleged scammer to demand for a “contract” in black and white and were told to meet at a shop, but only to be trolled.

Helpless, they decided to file a police report.

Reader not impressed with the Singapore Police Force (SPF)

Clearly, the reader was not pleased with the outcome after filing the police report.

Dissatisfied, reader concluded his post by criticizing the SPF for not being able to get the bank to freeze the account and thereafter return them the money, even after providing them with all the information that they have of the alleged scammer.

But erm… Police investigation takes time? And hor, the SPF are just law enforcer leh. In the Police Force Act, it states that police cannot suka-suka use their authority to execute summonses, subpoenas, warrants, commitments and other process unless the order is issued by courts and Justices of the Peace leh.

Whether you suka or not, protecting yourself against scams is ultimately a personal responsibility. Just be very very very careful!

Too long didn’t watch – but if you are interested in hearing his full story, you may watch his video below. Its 28-minute long by the way.

If you’d like to contribute your story to us, drop us an email at editors@sureboh.sg and we’ll review it. We read each submission that comes to us within two weeks of receiving it.