Remember years back when #returnbackmycpf was very 流行(trendy)? Years ago, #ReturnmyCPF protestors Han Hui Hui, Roy Ngerng and gang even disrupted a YMCA charity event where some special needs kids were performing then! Well, times changed liao. It seems like savvy Singaporeans are starting to realise how important retirement planning with CPF is – in 2021, CPF top-ups hit a new annual record of $4 billion! Correct. Many, many people VOLUNTEER to put their money into their CPF accounts. More than 220,000 people topped up their own or a family member’s CPF account! Finally, they realise the Gahmen is用心良苦 trying to help Singaporeans save for their needs from 20s, 30s, 40s, 50s, 60s, 70s, 80s…

On 1 January 2022, Singapore has also increased the Central Provident Fund (CPF) contribution rates for employees aged 55 to 70 years! Actually hor this increase was due in January 2021 but was pushed to 2022 to enable employers to manage costs during the pandemic. Then last year the National Trades Union Congress called out to the Gahmen to remind them that this cannot delay further already and asked for increases to CPF contribution rates for senior workers to take effect from Jan 1, 2022 – as planned! Steady lah! Now, the contribution rates will rise to 28 per cent for workers aged 55 to 60. Rates will also rise by 2 percentage points to 18.5 per cent for workers aged 60 to 65. The increases in rates for both age bands will be split between employers and employees, with both groups’ contributions rising by 1 percentage point each. This also means workers age 55 and above all get an instant pay increment of 1% on 1 Jan…

Why people not happy about CPF?

A lot of people not happy about the scheme is because they think that once the money goes in, is like kena stuck but there are many ways you can use the funds e.g. buy property, higher education, healthcare and even for investment…

This system is the Gahman’s way to support financial stability for Singaporeans. Eventually, when you retire, with CPF LIFE you can receive a lifelong income stream. Say real one, without CPF, most Singaporeans probably won’t even have the house they are living in lor.

CPF also offers very attractive, virtually risk-free interest rates. For those under the age of 55, CPF interest rates are currently 2.5 per cent for OA and 4 per cent for SA and MA. Plus, there’s an extra one per cent interest on the first $60,000 worth of combined balances (capped at $20,000 for OA).

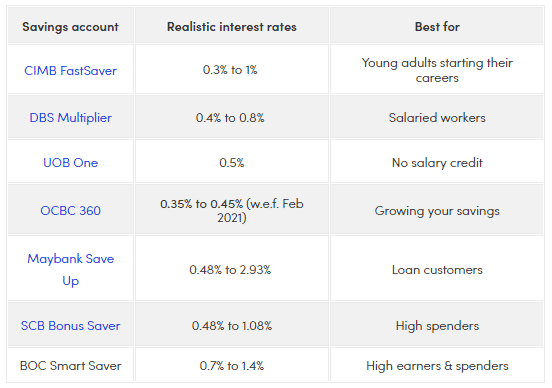

If you got dig around before, you should already know the kind of interest savings account can get for you liao.

BTW, in case you FOMO and also want to top up your CPF, you can easily do that online. And hor, if you hear “C-P-F” already triggered, tia gong those who make the most noise about CPF are the ones who need it the most *coughcough.

https://www.facebook.com/watch/?v=245474147461611