Two weeks ago, Finance Minister Heng Swee Keat announced in his budget speech that the Goods and Services Tax (GST) increase will not happen next year.

Basically, he is indirectly telling us that if we are hoping that they will scrape the plan to increase GST, we can forget about it lah. Sibei angry leh. Why do we even need to pay GST? The Gahmen should just remove it altogether. Because if the Gahmen remove GST, everyone will be very happy. You all say correct or not?

Then in his speech, this Heng Swee Keat said that the Gahmen’s total expenditure for 2020 will be around $83.6 billion, or 16.1% of our GDP. And the money will be spent mainly on these five areas: 1) Defence, 2) Education, 3) Healthcare, 4) National development and 5) Transport.

Which I think he like that is very buey swee liao loh.

Defence

Please loh, who really cares about Defence? Why do we need to spend so much on military just to protect Singapore’s sovereignty and Singaporeans’ well-being? We all scared kena attacked meh?

No defence budget? No problem. Just use lousy or koyak military equipment.

In fact, like that is even better. We don’t even need to spend money to diversify our sources of water or on national stockpiles of food and essential items in times of crisis – because everyone would have died anyway.

Education

Another ridiculous thing that the Gahmen is wasting the GST money on, is to spend money to subsidise Singaporeans’ education.

Invest so much money on education, give free primary school education and higher education subsidies to Singapore citizens is waste money de lah. After so many years of education, there are people still out there who do not know how to use their brains to understand simple concepts.

Really, no need to spend money to give free education to everyone one. Just cut the budget. If people can afford education then they can send their kids to school. If not then they can suck thumb and build castles in the air with their kids at home.

What give every child a good start in life, save it lah. Life is never fair anyway.

Healthcare

Also, I don’t understand why we need to spend money on healthcare.

We spend so much money on healthcare is because Singapore got a lot of old people, although some of the healthcare expenditure is also to help subsidise the poor who cannot afford to pay for their medical expenses.

But hmm, don’t say I bad-bad, but old people means they won’t live for very long, right?

For poor people, not enough money to pay then give them subpar medicine. Like, dilute the cough syrup or something also can.

So no need to spend money giving them subsidies or give them the best healthcare also can?

National development

The budget for this confirm guarantee plus chop must cut. Because I’m sure we all don’t need what HDB upgrading programme to upgrade our HDB flats lah!

If the lift spoil, then spoil loh, we can take the stairs – healthy lifestyle.

No need to spend money to build sheltered linkway in the neighbourhood also, we can just use umbrellas. Is it the Gahmen think we don’t have umbrellas at home?

Gahmen also no need to give too many housing grants for people to buy HDB flats. If these people want to buy flat, then they should make sure they have money in their bank. No money still want to buy flat. Take grants and buy already still got people complain it’s not their flat, rent only.

Transport

This one really is very extra and is no need one leh.

I don’t see why we should invest in our public transport system. It’s not like we want our transport system to be efficient, punctual, reliable and clean – we are used to delays and breakdowns liao, right?

We also don’t need to expand our train network and have so many train lines like Japan – we have two MRT lines can liao.

I mean Singapore how big only, I’m sure other Singaporeans living in areas not served by MRT can just walk. Come on, healthy lifestyle!

Do we really need GST?

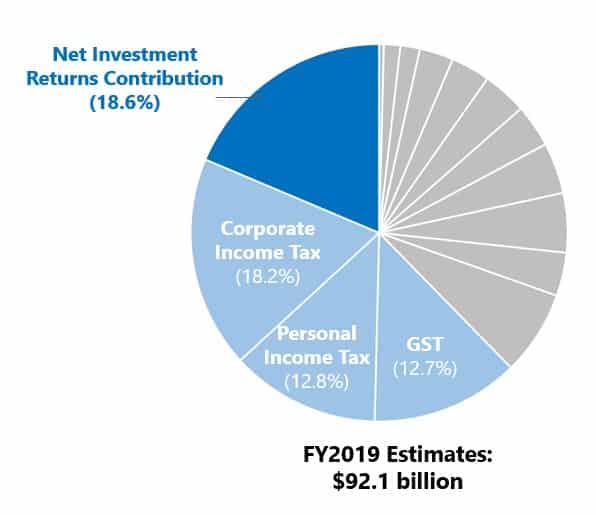

In case you don’t know, NIRC is currently the largest single source of Gahmen revenues, followed by Corporate Income Tax, Personal Income Tax and then GST.

These revenues, including the GST that you and I pay, will then be part of the money that pays for the Gahmen’s spending for the five things that I mentioned, among other things.

That means if we don’t collect GST, the 12.7% will be gone from the revenue pie chart.

That means if we don’t have the 12.7%, then we probably won’t have funding for stronger defence, better education, affordable healthcare, efficient transport, and steady-pom-pee-pee infrastructure.

That means if we don’t have enough funding, then we will have to make do with mediocre defence force, there won’t be free or heavily subsidised education for Singaporeans, our healthcare system will be very lousy – maybe use defibrillator halfway the machine will breakdown, we must suck thumb and live our lives with lok-kok transport system and sibei cui infrastructure… because money not enough loh.

That also means that we cannot make the rich people who spend a lot of money on luxury goods like Rolex, Hermes, Chanel pay for GST.

That means we also cannot make the tourists who come to Singapore to spend money pay for GST.

And when these smelly rich people don’t pay for GST, it means we will have little to no money to disburse to help the old, the poor and the needy via social transfer.

You know or not, foreigners who live here, tourists and top 20% of our households contribute to over 60% of GST? Heng Swee Keat say one, I saw on TV.

If it’s like that, do you still think it is ok to remove the GST leh?

Or you prefer to increase the personal income tax to like maybe 50%, since now only half of Singapore’s workers pay personal income tax?

If you’d like to contribute your story to us, drop us an email at editors@sureboh.sg and we’ll review it. We read each submission that comes to us within two weeks of receiving it.