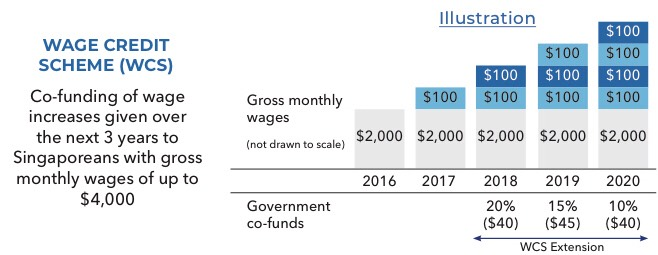

The Wage Credit Scheme (WCS) was first introduced in Budget 2013. Through this scheme, the government co-funds business owners for increasing their employees’ wages. It also aims to encourage business owners to share the productivity gains with their employees.

For employers to qualify for the WCS payouts for 2019, they must first increase the gross monthly income of Singaporean employees by at least $50 in 2018 and/or sustained the increase (at least $50) previously given to employees in 2017.

Employers must also make the necessary CPF contributions on 2018 wages for their employees to the CPF board by 14 Jan 2019.

Announced in Budget 2018, the WCS will be extended for three more years (2018 – 2020). Government co-funding of qualifying wage increases in 2018 will be still maintained at 20% but will be stepped down to 15% in 2019 and 10% in 2020.

All employers would not need to apply to receive the WCS payouts. Eligible employers will automatically be informed of the amount of WCS payouts to be received via letters from the Inland Revenue Authority of Singapore (IRAS) by March 2019.

How will the payout be given? Simple! The payouts will be credited directly into their company’s GIRO bank account used for Income Tax and GST, or their bank account that is registered with PayNow Corporate.

For any WCS computations queries, you can visit this link.

If you’d like to contribute your story to us, drop us an email at editors@sureboh.sg and we’ll review it. We read each submission that comes to us within two weeks of receiving it.