In case you missed the two-hour Budget 2018 speech delivered by Minister Heng Swee Keat in Parliament today, here are 5 key takeaways that you need to know.

1) Govt giving one-time off angbao

This is probably the best thing that happened in Parliament today.

It’s day 4 of Chinese New Year and Singaporeans above 21 will be getting a big fat angpao from the Government!

It’s a one-time off SG bonus and it’ll only be paid out end 2018 so don’t be too quick to spend your future money.

2) GST will increase to 9% from 2021-2025

Last week, we gave a few suggestions on how to siam (avoid) GST increase. You can refer to that as a guide.

The good thing about the GST increase is that it will only kick in earliest 2021 and latest 2025. That gives people and businesses time to adjust to the upward adjustment.

By the way, the permanent GST voucher scheme will be enhanced to help the lower-income Singaporeans.

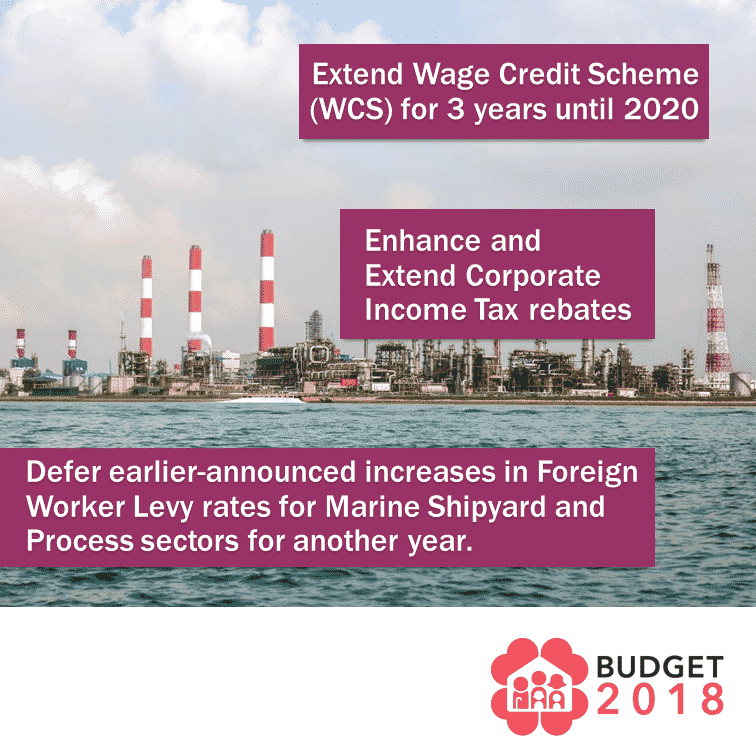

3) Lots of help for companies

Companies will be given a leg up to do better in the digital economy.

The Wage Credit Scheme, which co-funds wage increases for Singaporean workers earning up to $4,000, will be extended for three more years.

Increases in foreign worker levy rates for Marine Shipyard and Process sectors will be deferred for one more year.

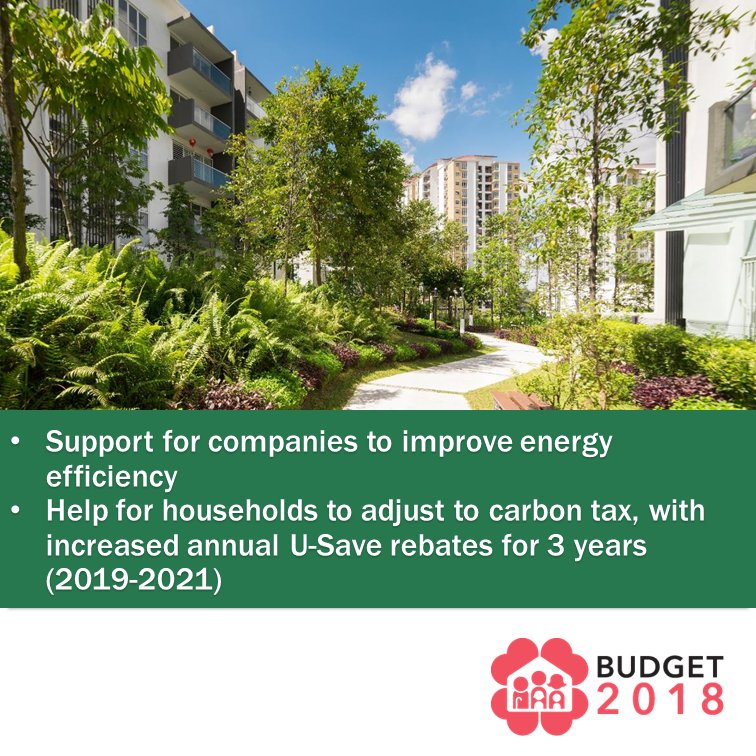

4) Carbon tax

This is a fight against climate change and in line with Singapore’s ratification of the Paris Climate Agreement in 2016.

There will be a carbon tax on the carbon content of fuels to encourage companies and individuals to reduce their carbon footprint.

It will be set at $5 per tonne of carbon dioxide-equivalent greenhouse gas emissions. This will kick in 2019 and reviewed in 2023.

The impact of carbon tax on households will be small and the annual U-Save rebates will be increased by $20 per household from 2019 to 2021.

5) GST for digital services

This will mainly affect businesses purchasing marketing, accounting, IT and management services.

For consumers, GST will apply to video and music streaming, apps, listing fees on e-marketplaces and online subscription fees.

The Government is still considering whether to implement GST for goods purchased online.

Right now, there is no GST for online purchases below $400.

Others

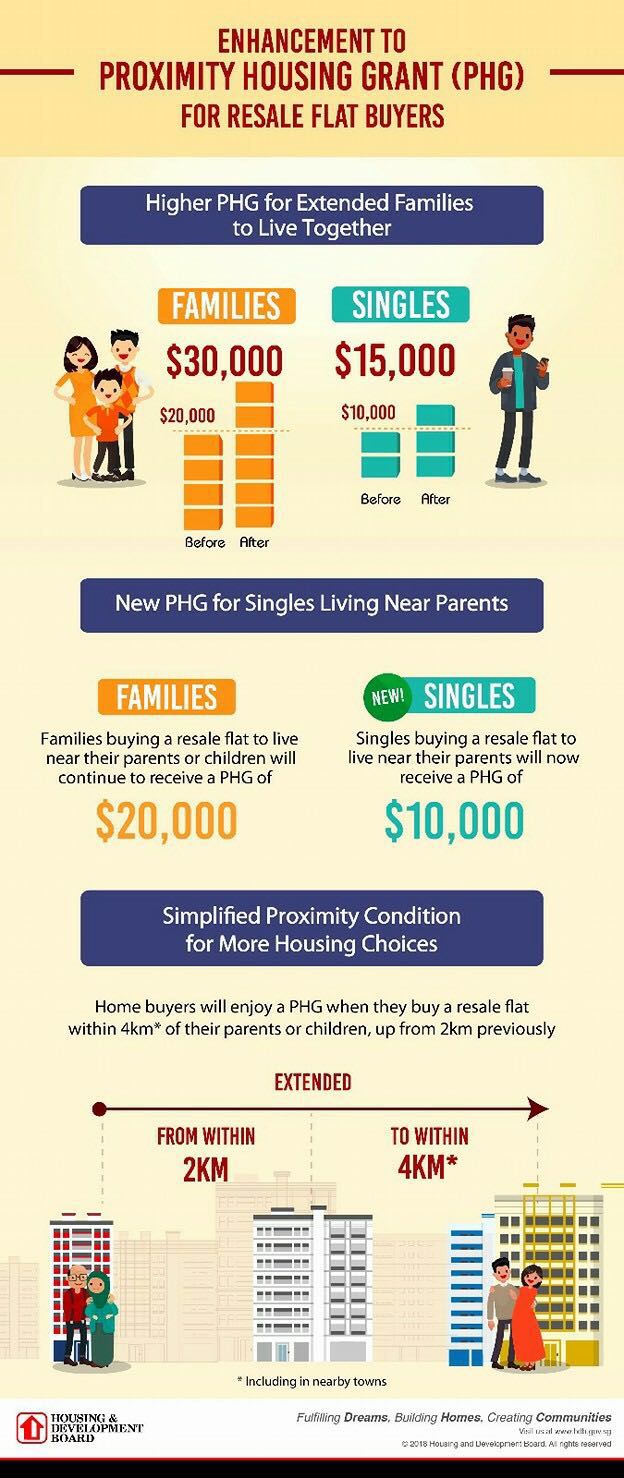

Other key announcements include the enhanced proximity housing grant, increased support for education and new national projects to develop Singapore into a smart nation.

If you’re thinking of buying a resale flat, consider this:

If you’d like to contribute your story to us, drop us an email at editors@sureboh.sg and we’ll review it. We read each submission that comes to us within two weeks of receiving it.